Table of Contents

Ultimate Guide to United Airlines

As a challenger trying to dethrone Delta Airlines, United Airlines is on the path to be the most profitable airline in the world. As such, they have been upping their game recently. They have expanded their route network, added premium touches to their soft product, starting to refresh their polaris seats, and revamping their credit cards. Here is a guide to their program.

Top 5 Takeaways

- No Carry On in Basic Economy

- Expanded Award Availability: Premier members and credit card holders have access to expanded award availability.

- Marriott Partnership: Reciprocal Benefits for Marriott elite members and United Premier members.

- United Mileage Pooling: Family members are able to pool all their miles together, and redeem them for award flights.

- Route Network: United is a part of Star Alliance, the largest airline alliance in the world. They also serve the most international destinations out of every US carrier, making their miles be able to redeem for the most number of destinations.

United Hubs

United Airlines runs hubs in some of the highest earning cities in the US. Furthermore, only 2 of their hubs are hubs of other full service carriers (LAX and ORD). In the case of Chicago Ohare, they are beating American Airlines by a handy margin. Although they are losing to Delta Airlines in LAX, United bases most of their transpacific operations out of SFO. Their hubs are as below:

- Denver International Airport (DEN)

- Chicago O'Hare International Airport (ORD)

- Newark Liberty International Airport (EWR)

- Houston George Bush International Airport (IAH)

- San Francisco International Airport (SFO)

- Los Angeles (LAX)

- Guam's Antonio B. Won Pat International Airport (GUA)

To complement their hubs, United has a couple of flights not operated to or from their hub airports. I would consider these more like focus cities.

- Cleveland Hopkins International Airport (AUS)

- Tokyo-Narita International Airport (NRT)

- Hong Kong International Airport (HKG)

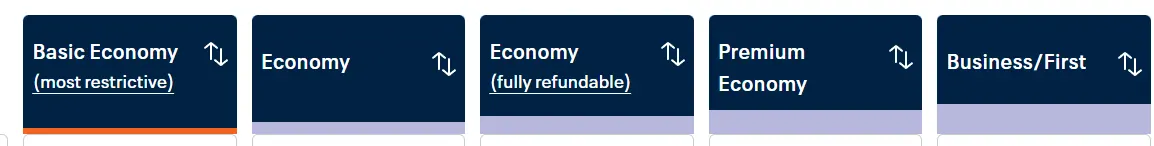

Fare Classes

United divided their fares into 5 different buckets. Keep in mind, Basic Economy, Economy, and Fully Refundable Economy all have the same seats, just different refund policies. Polaris, business and first class will all full under the right most bucket, depending on the route. Only one fare will exist for each route but expect that one of the 3 will always be the most premium fare.

Basic Economy

Basic economy (N), like all other airlines, is the cheapest but most restrictive fare class in United. Basic economy fares give you all the same onboard experience (service, seat type, and amenities) as a regular economy seat would. However, United's basic economy differs from its competition in that it does not allow for a free carry-on.

- Baggage Policy: 1 personal item for free, carry on for fee ($40), checked bag for fee (1st: $35, 2nd: $45)

- Boarding Group: Group 6

-

Upgrades: Upgrades using cash can be done anytime and to any fare

class.

*Elite status and MileagePlus credit cards will not provide complimentary upgrades. Upgrade

certificates are also ineligible to be used. - Seat Selection: Seat Selection for a fee. *Elite status preferred seat selection benefits are ineligible.

- Mileage Earnings: Flights are ineligible to earn PQF but will earn everything else.

- Same Day Changes: Elite status same day confirmed or same day standby changes benefits are ineligible.

- Lounge Access: Eligible credit cards and lounge memberships grant United Club access.

-

Change and Cancellation Policies:

- 24 Hour Risk-Free Cancellation: All flights booked through United (cash and MileagePlus) are eligible for a full refund or change (minus price difference) if cancelled within 24-hours of booking.

- After 24 Hours: All cash flights booked through United can be cancelled for a fee. Fee is $49.50 for domestic flights and $99.50 for international flights.

Economy

Economy (G,L,K,S,T,Q,V,W,M,E,H,U,B,Y) United's standard seats. Fare class G is the LOWEST discounted economy price. If you see one of these, don't hesitate to buy. Basic economy fare buckets match main cabin ones, even if the fare codes all say N. As such, basic economy fares are also the cheapest when economy displays K, L, T, or S fare codes. Do note that while economy tickets can select seats, selecting "Economy plus" seats will cost extra. These seats tend to be located in the exit row, or front of the cabin.

- Baggage Policy: 1 personal item for free, carry on for fee ($40), checked bag for fee (1st: $35, 2nd: $45)

- Boarding Group: Group 3-5, depending on window, middle, or aisle seat.

- Seat Selection: Free seat selection for all regular economy seating.

- Lounge Access: Eligible credit cards and lounge memberships grant United Club access.

-

Change and Cancellation Policies:

- 24 Hour Risk-Free Cancellation: All flights booked through United (cash and MileagePlus) are eligible for a full refund or change (minus price difference) if cancelled within 24-hours of booking.

- After 24 Hours: Non-refundable economy tickets will refund full ticket price to travel credit if cancelled. Refundable economy will refund full ticket price to original form of payment. All changes are free and will only cost fare difference.

First and Business

United first and business class (P,Z,C,D,J) is located at the front of the plane for short haul international and most domestic US flights. Both products feature the same seat with more legroom and recline than economy seats. United business markets products come with United Club access.

- Premier Access: Separate check-in line, expedited baggage arrival, exclusive security lines at select airports.

- Amenities: Blankets, inflight alcohol, and wider selection of inflight snacks.

- Baggage Policy: 1 personal item and carry on for free, 2 free 70 lbs checked bags (3rd-10th)

- Boarding Group: Group 1

- Seat Selection: Free seat selection for all first class seating.

- Lounge Access: Eligible credit cards and lounge memberships grant United Club access. The differentiator between United business and first flights is that United Business will get access to United Club lounges while United first does not.

-

Change and Cancellation Policies:

- 24 Hour Risk-Free Cancellation: All flights booked through United (cash and MileagePlus) are eligible for a full refund or change (minus price difference) if cancelled within 24-hours of booking.

- After 24 Hours: Non-refundable First or Business tickets will refund full ticket price to travel credit if cancelled. Refundable First or Business tickets will refund full ticket price to original form of payment. All changes are free and will only cost fare difference.

United Polaris

United Polaris (P,Z,C,D,J) is United's flagship lie-flat seat cabin. Like Premium Plus this cabin is reserved for most Uniteds long haul international and premium domestic flights. United has put extra investment to having all bedding sourced from Saks Fifth, making its mattress one of the best in the sky.

- Premier Access: Separate check-in line, expedited baggage arrival, exclusive security lines at select airports.

- Amenities: Amenity kits, noise cancelling headphones, Saks Fifth blankets, water bottle at seat, pre departure drink, and widest selection of inflight snacks.

- Baggage Policy: 1 carry-on and 1 personal item, 2 free 70 lbs checked bags, (3rd-10th)

- Boarding Group: Group 1

- Seat Selection: Free seat selection for all regular polaris seats.

- Lounge Access: United Club and Polaris lounge access on both departure and arrival.

-

Change and Cancellation Policies:

- 24 Hour Risk-Free Cancellation: All flights booked through United (cash and MileagePlus) are eligible for a full refund or change (minus price difference) if cancelled within 24-hours of booking.

- After 24 Hours: Non-refundable Polaris tickets will refund full ticket price to travel credit if cancelled. Refundable Polaris will refund full ticket price to original form of payment. All changes are free and will only cost fare difference.

Earning MileagePlus

Today, there are many ways to earn MileagePlus, through both flying and non-flying means. Obviously, spend on United MileagePlus credit card will earn MileagePlus but I have saved that for a later section.

United Flights

United has made United mileage accrual on their own metal and marketed flights very simple: just

based off how much you spend and what elite status you are at. The following is the calculation of

miles accrued on each flight:

General Member: 5 miles per dollar

Premier Silver: 7 miles per dollar

Premier Gold: 8 miles per dollar

Premier Platinum: 9 miles per dollar

Premier 1K: 11 miles per dollar

Partner Flights

Flights marketed and operated by partner airlines earn MileagePlus based on the number of miles flown. United Partners are not limited to Star alliance partners.

- Aegean

- Aer Lingus

- Air Canada

- Air China

- Air Dolomiti

- Air India

- Air New Zealand

- Airlink

- ANA

- Asiana

- Austrian Airlines

- Avianca

- Azul

- Brussels Airlines

- Cape Air

- Copa Airlines

- Croatia Airlines

- Discover Airlines

- Edelweiss

- Egypt Air

- Emirates

- Ethiopian Airlines

- Eurowings

- EVA Airways

- Flydubai

- ITA Airways

- JSX

- Juneyao Air

- LOT Polish Airlines

- Lufthansa

- Lufthansa City Airlines

- Olympic Air

- Shenzhen Airlines

- Singapore Airlines

- South African Airways

- Swiss International Air Lines

- TAP Air Portugal

- THAI Airways International

- Turkish Airlines

- Virgin Australia

Transfer Partners

Chase Ultimate Rewards: All ultimate rewards (UR) points to MileagePlus at a rate of 1 to 1

through the sapphire cards or ink preferred card.. This makes cards like the Chase Freedom Unlimited, which earns 3x points per dollar

on dining and drugstores, effectively earn 3x United miles on dining and drugstores. Given that the value of MileagePlus is

not typically the best value when compared to other transfer partners like Air Canada's Aeroplan, I would discourage transferring unless to top

off points for a redemption.

Bilt Rewards: All Bilt points transfer to United Mileageplus at a rate of 1 to 1. Same story for value here.

Marriott Bonvoy: Marriott Points are also able to be transferred at a rate of 2

Bonvoy points to 1 MileagePlus if transferring in increments of 60,000 Marriott Bonvoy points. It used to be a terrible deal but during

typical Marriott point sales, if you buy at 0.89 cents per point, then transfer to United, it is effectively buying United miles at 1.78 cents per

point. This is usually cheaper than when United miles are on sale for 1.88 cents per point.

Everyday Partners

These direct partners will earn X amount of MileagePlus based on the amount of money spent.

A couple of the more notable partners are listed below:

Vivid: 2 miles per dollar spent

Turo: 5 miles per dollar on first purchase and 1 mile per dollar thereafter

VRBO: 3 miles per dollar

For a list of other partners, visit United's website

United Affiliate Portals

United MileagePlus X: A unique app that shows challenges to earn United miles when completing certain activities.

United Hotels: Earn 2 miles per dollar spent on base hotel rates booked through United Stays.

United Vacations: Earn up to 10,000 MileagePlus per person when booking through

United

Vacations.

MileagePlus Dining: Earn MileagePlus when purchasing

from

participating restaurants in MileagePlus

Dining

while using a credit linked to the dining portal.

MileagePlus Shopping: Earn MileagePlus when purchasing

items

through MileagePlus Shopping.

Other Methods/Partners

For other ways to earn MileagePlus and more partners, visit MileagePlus partners.

Redeeming MileagePlus

I would say that United miles are in the middle of the pack, not as lucrative as American Airlines but not as atrocious as Delta Skymiles for redeeming on business class.

Points Pooling

United MileagePlus members can create a pool for their miles. Members in this pool can decide how many miles they want to contribute and the creator/leader can decide who can redeem the miles. There is a maximum of 4 members in a pool, with the miles in the pool only able to be redeemed for United operated flights.

United Flight

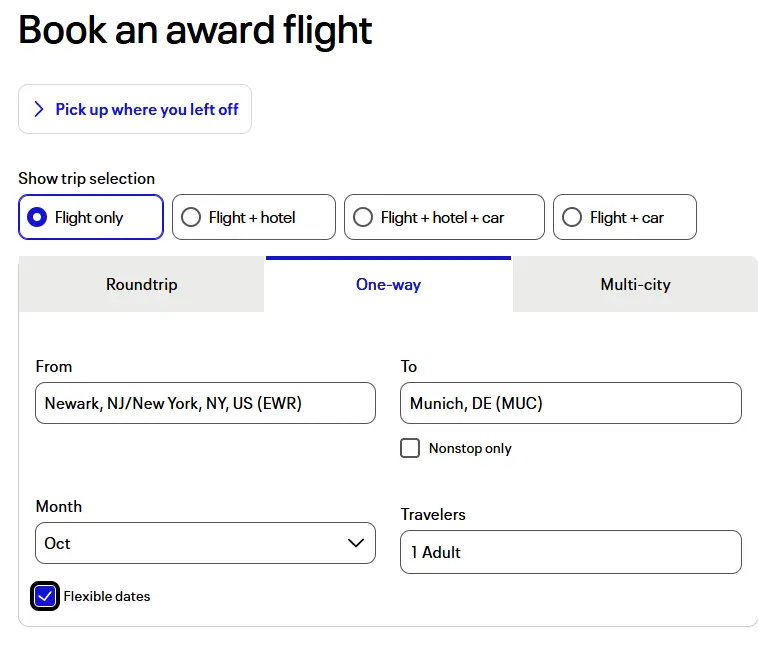

US carriers have one of the best online user interfaces for booking award flights. United, for instance, just requires you to click "Book"->"Award Travel"

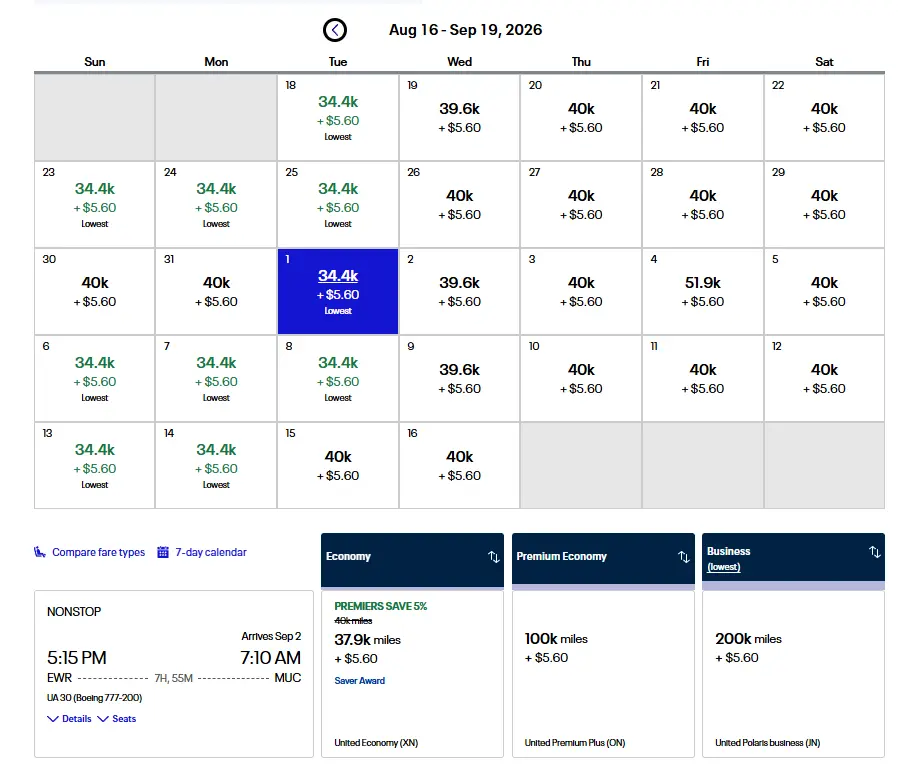

There is even an award calendar when selecting "Flexible dates" when selecting your itinerary. This will allow you to look at awards with a monthly view.

This will then expand into a monthly calendar view!

Generally, these MileagePlus are worth around 1-1.5 cents per point. This applies even for business class flights, which is why people call the currency SkyPesos. However, there are 4 things that stand out about United compared to other currencies.

-

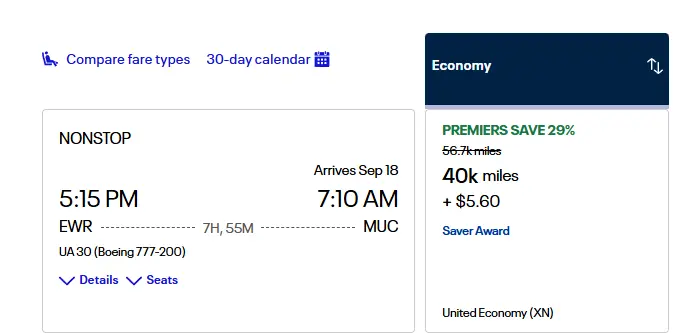

Expanded Saver Awards: United awards typically have a floor for the amount of points they charge. They call this Saver

award availability. For all Premier members and credit card holders will get expanded access to United economy

saver awards. These awards will show up with a fare class of XN.

For Premier Platinum and 1K members, they are able to access expanded saver level business awards as well.

These awards will be denoted as fare class IN.

For Premier Platinum and 1K members, they are able to access expanded saver level business awards as well.

These awards will be denoted as fare class IN.

- Fuel Surcharges: United does not pass on fuel charges to your award ticket. This is most important for when you look at flights from partner airlines, which some do try to charge their members, whereas United eats those fees for you.

- Free Changes and Cancellation: Probably the best thing about United awards is the ability to freely change and cancel tickets if not in Basic Economy. This allows for a lot of flexibility and is a great program to book backup flights with.

Partner Flight

United has a very large selection of partners that MileagePlus can be redeemed for. Generally, the best value can be had from redeeming on partner award flights, specifically for Star Alliance flights. A highlight of United's program in this regard is the lack of fuel surcharges and booking fees tacked onto partner flights, such as Lufthansa and ANA. I am working on an article compiling an unofficial partner award chart for United's MileagePlus program.

Flight Upgrades

Upgrades for flights generally cost around 1 cent per mile to the cash upgrade price. What is interesting is that United also allows for upgrading with miles for paid tickets on Star Alliance airlines. To see if there is is eligible space, fill out this form.

Other Options

United has many more

options

on their website for redemptions do not offer good value. A vast majority of the redemptions fall under

1 cent per mile.

United Elite Status

Premier Status Requirements

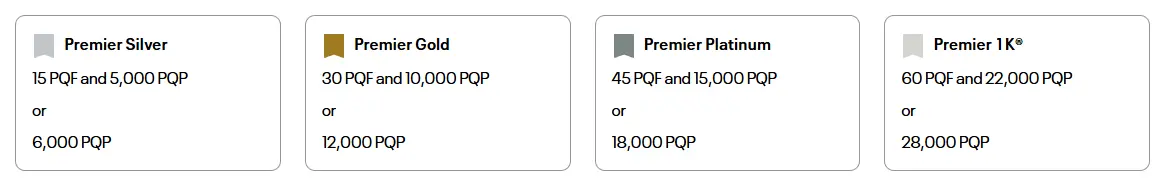

United has 4 tiers of status for their Premier members.

There are 2 metrics for tracking elite status with United: Premier Qualifying Flights (PQF) and Premier Qualifying Points (PQP). Below are the ways to earn both PQP and PQF.

- United Flights: 1 PQP per dollar spent on paid flights. Taxes and fees don't count towards PQP. Earn 1 PQF per paid flight segment.

- Award Flights: 1 PQP per 100 miles spent on award flights.

-

Partner Flights All paid Star Alliance flights will earn 1 PQF per segment. Preferred partners will earn 1 PQP for every 5 miles earned.

Non preferred partners will earn 1 PQP for every 6 miles earned. - Credit Cards: 1 PQP per $15 spent on Chase United Club and Club Business card with a limit of 28,000 PQP spend accrual per calendar year. 1 PQP per $20 spent on Chase United Explorer, United Quest, and United Business cards. United Explorer has a limit of 1,000 PQP, United Quest with 18,000 PQP, and United Business with 4,000 PQP spend accrual per calendar year. In addition, the United Quest card will give an automatic 1,000 PQP bonus each year, while the United Club and Club Business cards will each give an automatic 1,500 PQP bonus each year.

- Promotions: United may run promotions to earn PQPs, such as with United stays, vacations and more.

Premier Benefits

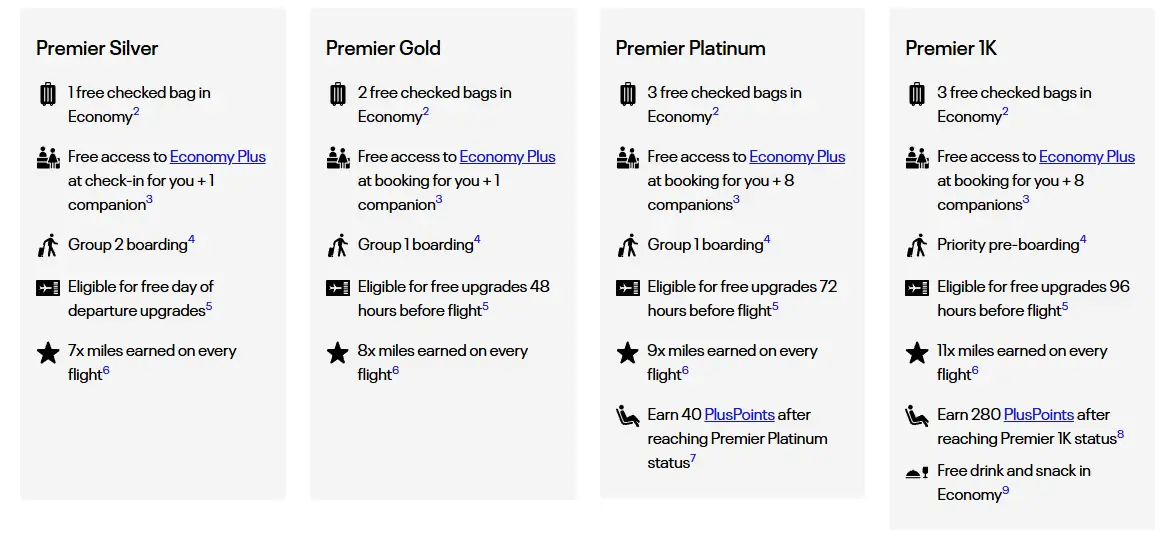

The list below are the benefits that all Premier members have. I have ranked the list in order of which I find to be the most valuable benefit.

- Additional checked bags

- Economy Plus seating at check-in.

- Complimentary Companion Upgrades

- Priority Boarding

- Priority Check In

- Priority Waitlist Status

Premier members also start off the year with additional PQP based on the premier level.

- Premier Silver: 300 PQP

- Premier Gold 600 PQP

- Premier Platinum: 900 PQP

- Premier 1K: 1400 PQP

The chart below summarizes the benefits that differ for each tier:

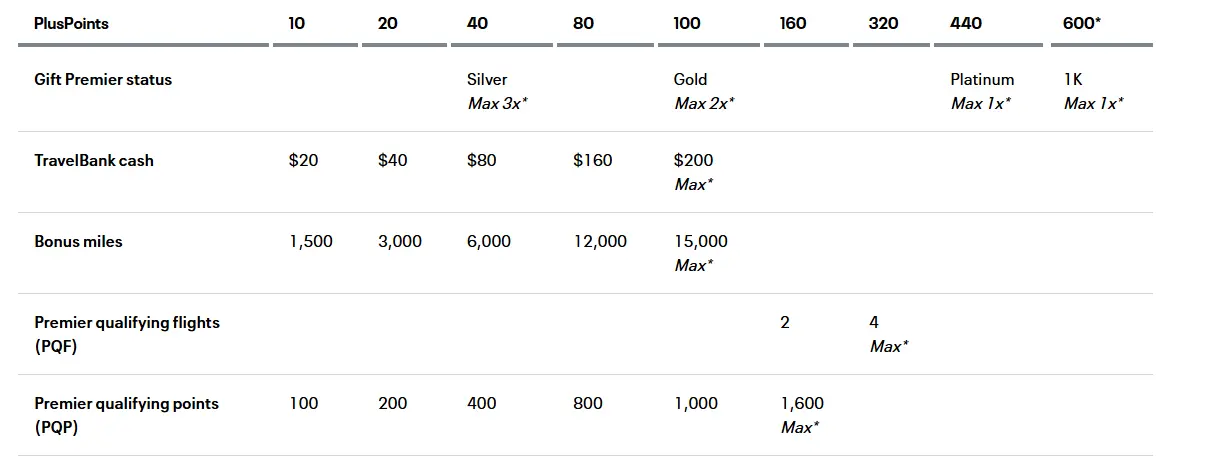

PlusPoints

For those that reach Premier Platinum and 1K, you can receive 40 PlusPoints for Premier Platinum

and 280 PlusPoints for Premier 1K. For every 3000 PQP earned after 22,000 PQP, earn 20 more PlusPoints.

PlusPoints can be used for guaranteed upgrades. The pricing for PlusPoints upgrades have moved to

dynamic pricing, meaning there is no set price on the number PlusPoints needed for an upgrade.

Additionally, they can be used to exchange for other elite status perks, miles or Travel bank cash, as seen

below.

Status Match

United offers status matches to other airline elites. Eligible airlines include:

- Alaska Airlines

- American Airlines

- British Airways

- Delta Air Lines

- Southwest Airlines

The requirements are a reduced number of PQP spend to reach the elite status thresholds.

Million Miler

For every 1 million miles flown, United awards lifetime elite status. United counts miles flown on cash booked United

operated flights. For each lifetime status, a companion can also receive the lifetime status too.

Companions can be chosen each year and is a great way to get player 2 on board with flying so much. Each threshold Million miler thresholds

are as follows:

- Premier Gold - 1 million miles

- Premier Platinum - 2 million miles

- Premier 1K - 3 million miles

- United Global Services - 4 million miles

MileagePlus Credit Cards

United credit cards are very powerful for those traveling on United. From my view, there is generally

2 strategies for the cards. For those that are casual enjoyers of the United Club lounge, an United business

card paired with an United Gateway card can be highly synergistic. Instead of just holding an United Explorer card

for the checked bag and 2 Club passes, holding an United business card and gateway card can provide all that and

an additional 5,000 United miles each year. For avid United fans chasing status or frequently visit the United

clubs, the United Club card would be the way to go.

United Gateway

There is not much to write home about the United Gateway card, except that this is a $0 annual fee card. This means that it is a great downgrade option for personal United cards.

United Explorer and Business

The United Explorer and Business cards start coming with introductory perks for a low annual fee. The main draws for these cards are the checked bag benefits and the united club passes. As mentioned earlier, the business card is generally going to be more valuable for most people. For most people getting a card of this tier, it is expected to at least fly 5 times a year. Triggering the $125 credit for 5 flights should be easy for the target audience for this card. Pair that with the "Better together" anniversary bonus of 5,000 miles, this could easily recoup the annual fee of the card. Furthermore, cards from this annual and higher will have access to United Polaris saver award availability.

United Quest

Hot take, but I find this card to be extremely lackluster. It just doesn't feel like the card can provide anymore outsized value than the explorer card could. Some could argue that there are more credits to justify the annual fee. However, why would I get a card, spend time and effort just to use the credits and break even? Many of the perks also overlap with the Explorer card. The only time I would recommend this card is if they fly United often with 2 checked bags and absolutely do not value United Club access at all.

United MileagePlus Reserve and United MileagePlus Reserve Business

The flag ship benefit of the United Club cards are the United Club access. Since both cards also provide 2 free checked bags, this is why I mentioned that the Quest card would only be valuable for those that do not value United Clubs at all. Both cards come with Avis President's Club, which is Avis's highest status and not one that any other credit card will provide. For those chasing elite status, the personal club card will grant 1,500 PQP each year just for holding the card and 1 PQP per $15 spent on it. The card also gives a 10% discount on economy saver awards in continental US and Canada, similar to a perk found on the Delta cards. To top it off, the card also grants IHG Platinum status.