Table of Contents

Why Bilt 2.0 is Better than it Seems

Bilt 2.0 was released a week ago. On initial launch, the product was met with mixed reactions. They took away the simplicity the Bilt 1.0 offered and created the world's first ever "mathification". The days of earning free Bilt points on rent are over. However, the cards still might make a lot of sense for people. You just have to bear with me a little, as concept for "Bilt cash" and the math for earning points on rent gets to be quite intense.

Bilt Credit Card Lineup

Bilt Blue Card

The no annual fee starter Bilt card is as straight forward as the lineup gets, earning 1x Bilt points and 4% Bilt cash on everything. More on what Bilt cash is and how to "earn" points on rent/mortgage will follow.

Bilt Obsidian Card

The next card one ups the Chase Sapphire Preferred with an annual fee of $95 and 2 $50 credits with their hotel portal, rather than 1. The card's main draw is 3x on dining or groceries up to $25k in spend, a category Chase Sapphire Preferred only limits to dining and online groceries. Unfortunately, the 3x category is not on both dining and groceries, unlike many other cards (ie Citi Strata Premier and Capital One Savor).

Bilt Palladium Card

The high annual fee luxury travel card imitates the Capital One Venture X with 2x Bilt points on every purchase. The main draw is the ability to get a priority pass membership. What the card is lacking is a fast track or automatic Bilt status for holding the card and a TSA Precheck/Global Entry credit.

Bilt Cash

Bilt allows for Bilt cash to be redeemed dollar for dollar on their merchants. The list of ways to use it is on the Bilt page. The uses I find to be more valuable are listed below:

- Extra 1x Bilt points on all purchases up to $5000 for $200 Bilt cash (redeemable 5 times per year). This is particularly interesting because as long as you spend less than $25,000 a year, you can effectively earn 3x on Palladium and 4x on dining or grocery on Obsidian. By spending $5000 on a Bilt card, you will earn $200 Bilt cash. This means, you don't have to play any of the coupon games and can just think about earning the aforementioned multipliers as long as you spend less than $25000 in a given year.

- $10 per month towards Wallgreens.

- $10 per month towards Lyft.

- $25 per month towards select Bilt partner restaurants via Mobile Dining Checkout.

- $50 (Blue/Silver) or $100 (Gold/Palladium) per month towards Bilt Hotels (2 night minimum).

- $5 per month towards Bilt Neighborhood Parking.

Rent and Mortgage

Bilt has completely revamped how to earn points on rent and mortgage with Bilt 2.0. What they offer now cannot, in my eyes, be considered earning on rent anymore. For every dollar you spend on rent, you have an opportunity to "earn" 1 Bilt point per dollar by spending 3 cents in Bilt cash. You are now effectively buying Bilt points at 3 cents per point. Keep in mind, under this new system, there is no cap on how much you can pay in rent/mortgage and no transaction fees for paying this way. However, the balance you incur for rent will now automatically be charged to your bank account, instead of being on your credit card balance.

Changing the Way to Look at Bilt cards

With this new direction and addition of Bilt cash, I believe the cards should not be viewed as pure rent cards, but rather cards with best in class ratios for earning transferrable currencies. Unfortunately, this also has conditions as well...

Bilt Math

All new Bilt cards earn 4% Bilt cash for every dollar they spend. Since you can now "buy" Bilt points for

3% in Bilt cash, as long as you spend less than 75% of your rent/mortgage each month on your Bilt card, the math

essentially becomes this:

4% Bilt cash per dollar / (3% Bilt cash / 1x Bilt point) = 1.33 Bilt point per dollar.

You will earn an additional 1.33 Bilt points per dollar on Bilt card spend less than 75% of your rent/mortgage each month.

Bilt Multipliers

Since we just established how Bilt cash can be redeemed, we can conclude that at the minimum, the 4% Bilt cash can be worth 1.33x Bilt points

to 4% cash back. The rest of this article's comparisons, each Bilt point will be valued as 1 cent. This makes a floor of 1.33 Bilt points

1.33% cash back.

We can now reevaluate the multipliers on each Bilt card with the addition of Bilt cash values on top of the multipliers they already earn (floor/ceiling),

assuming you spend less than 75% of your rent on the card:

Bilt Blue: 2.33-5% on everything

Bilt Obsidian: 4.33-7% on dining or grocery, 3.33-6% on travel, 2.33-5% on everything else

Bilt Palladium: 3.33-6% on everything

For the no annual fee Blue card, having a floor of 2.33x Bilt points will beat out cards like the Citi Double cash, Capital One Venture X,

and Amex Blue Business Plus.

The Obsidian card would at least give 4.33x on dining or groceries, better than the Amex Gold card and all the other 3x transferrable cards

with dining/groceries.

The Palladium card would have an industry leading (and by a large margin) floor earning rate of 3.33x on everything. This beats out

even the Robinhood gold card, which only gives cashback instead of valuable Bilt points.

Alternative Options for Paying Rent

There are 5 credit cards that would earn multipliers greater than 3% or 3x on rent that are worth talking about.

Coincidentally, they all come from Bank of America. First, a partner of Bilt, is the Bank of America Atmos Summit

and Bank of America Atmos Ascent card. Paying rent, not mortgage, will incur a 3% fee but earn 3x Atmos miles per dollar,

up to 50,000 miles. Since spend on the cards count towards Atmos elite status, depending on how much you value Atmos miles or

Atmos elite status, this could be a good deal.

The next tip is not intuitive and could change at any time. Probably not intended but Bank of America

codes their travel category to include rent. This makes 3 cards very interesting.

Bank of America Premium Rewards and Bank of America Premium Rewards Elite both earn an unlimited 2x points on travel (redeemable for

1 cent per point). What is notable is that Bank of America has a

Preferred Rewards program that increases multipliers depending

how much your assets are worth. In short, with $100k+ assets with Bank of America or Merrill Edge the cards will earn 3.5% on rent.

Subtracting the typical 3% credit card transaction fees that rent typically charges, you are left with 0.5%. As of right now,

paying rent through Bilt earns 0.5x per dollar. You are left with 1x/1% profit on rent,

roughly the same value as the old Bilt card.

The last card would be the Bank of America Customized Cash Rewards. This card earns 3% on travel on up to $2,500 spend per quarter.

Factoring in the Preferred Rewards increased multiplier, this comes out to 5.25% back on rent. This is significant because you can

obtain multiple Customized Cash Rewards cards through product changes or applying for their co-branded customized cash rewards cards.

As long as your rent is under

$2.5k, you can cycle through 3 cards each month to earn 5.25% back. Subtracting the typical 3% fee for rent, you are left with 2.25%. Stacking

in the Bilt points, you will earn 2.75% in profit. I have personally tried and earned elevated rent multipliers through Bilt in December 2025.

What This All Means

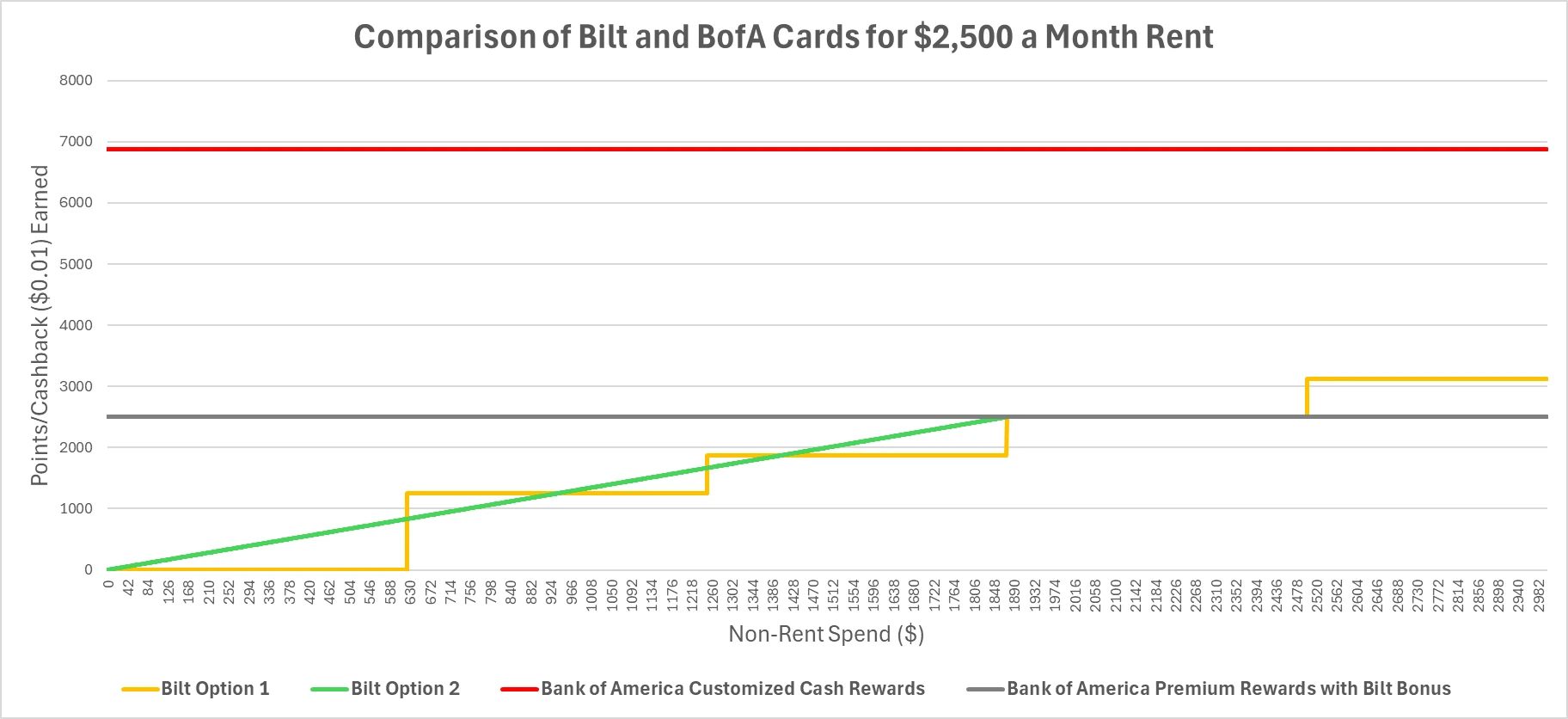

I have compiled a graph to illustrate where the cards intersect to earn points on rent, given a $2,500 per month rent cost. Since there is a 3% fee and not everyone value Atmos miles equally, I omitted the Atmos credit cards for this example. Each condition below is in the ordered by which to consider first:

- If rent under $2,500 a month: Bank of America Customized Cash Rewards

- Otherwise if monthly spend on Bilt card is greater monthly rent: Bilt Option 1

- Otherwise if spend on Bilt card is greater than 50% of month rent: Bilt Option 2 (most of the time)

- Otherwise: Bank of America Premium Rewards

I personally don't spend more than $2,500 a month on rent so I am rocking the Bank of America Customized Cash Rewards.

For mortgage owners, Bilt option 1 would only out earn Bilt option 2 consistently when spending more than the monthly mortgage on

the Bilt card. At this level of spend and given the current limited options to redeem Bilt cash, I would recommend choosing option one.

The general guideline I would provide is to choose option 2 if you plan on spending less than what you pay on your mortgage each month on

the Bilt cards. Choose option 1 if you plan on spending more.

The biggest winners for Bilt card users are people who prefer to use the card for everyday purchases and value Bilt cash redemption, as you can get

as high as 6% on all purchases and 7% on dining or groceries. Pivoting the Bilt strategy to be of everyday spend would give the most return.

In fact, for those not interested in playing the Bilt cash game, the 1x multiplier makes it very simple to earn a high multiple on your spend.

For me personally, I am looking to hold the Bilt Obsidian card long term, as it gives me a valuable multiplier on groceries. I could also see

people holding the Bilt Palladium card too.

Assuming you can maximize the Bilt cash, I would give the Bilt cards an A Plus Pro grade on everyday spend.