Table of Contents

Ultimate Guide to Hilton Hotels

For those that travel less than 5 times a year, Hilton is a fantastic program. For casual travelers, Hilton offers unique perks that do not require sinking much time or money into the program. I am here to walk you through how to get the most out of the Hilton Honors program!

Top 5 Takeaways

- Purchasing Points: Hilton points very often go on sale for 0.5 cents per point throughout the year.

- Elite Food Benefit: Elite status "food" benefit comes with both Gold and Diamond members. Internationally, this is a free breakfast for 2, in line with most hotel programs. However, in the United States this credit is dolled out in "food and beverage credits", which could be used for any meal of the day but usually not enough to cover the entire meal.

- 5th Night Free: The 5th night is free on all award bookings. Combined with the points sales and Hilton awards often costing 0.5 cents per point, buying points for a free fifth night is really easy to achieve.

- Top Tier Elite Status: The Hilton Aspire card can be an easy way to get top tier diamond status for little effort.

- Free night certificate: The Hilton credit cards come with or have opportunities to earn a free night certificate, usable at any Hilton property with standard award availability. This could net $1000+ when used for luxurious properties, like Waldorf Astoria, Conrad and even their partners, like SLH.

Earning Hilton Honors Points

Hilton Stays

The Hilton points earning rate is based on the amount of money spent,

with the budget brands Home2 Suites, Tru Hotels, Homewood Suites, and Spark hotels

earning half of what other brands earn, as shown below.

General Member: 10 points per dollar

Silver : 12 points per dollar

Gold : 18 points per dollar

Diamond : 20 points per dollar

Please do note that like most other hotel programs, booking through third party like Expedia

or travel portals

don't earn points. There are also frequent lucrative promotions, like ones that triple the amount base

points earned.

Buying Points

My favorite way of earning Hilton Honors Points (except credit card welcome offers)! Normally, points are on sale for 1 cent per point but many times throughout the year, points are on sale for 0.5 cents per point, pretty amazing when coupled with 5th night free! Unfortunately, there is maximum of 80,000 points purchased per account per year, but the limit is typically increased when the points go on sale. Also, Hilton points pooling effectively increases the annual purchase limit.

Meetings and Events

Earn 1 point per dollar when hosting a meeting or event at a Hilton hotel, up to 100,000 points each year.

Dining Portal

Much like other programs, a credit card can be linked to their dining program to earn Hilton Honors points on partnered restaurants. Note that linking a credit card to one dining program will usually unlink it from others. As Hilton points are not worth that much, I would advise against this.

Transfer Partners

All of the below transfer partners represent a poor value at the ratio they are transfer. At

the transfer ratio listed below, I would highly discourage transferring.

Amex MR: 1 Membership Rewards point to 2 Hilton Honors points. This pegs the MR point at 1 cent per point. MR

points are worth at a minimum of 1.1 cents per point when cashing out through Charles Schwab

Invest with rewards so this is not a good deal.

Bilt: 1 Bilt point to 1 Hilton Honors point

Diners Club: 1250 Club Rewards to 2000 Hilton Honors Points

Virgin Atlantic: 10,000 Virgin Points to 15,000 Hilton Honors points

Amtrak: 5000 Amtrak points to 10,000 Hilton Honors points

Everyday Partners

Lyft: Earn 3 points per dollar on regular Lyft rides and 2 points per dollar on

shared Lyft rides. Would not recommend since 2 Bilt points per dollar is more valuable.

Car Rentals: Earn 500 points per day and 500 points per rental, up to 5000 points for

renting with

Alamo,

Enterprise, or National.

Redeeming Hilton Honors Points

Hilton Stays

Hilton no longer has an award chart, but rather are categorized into standard and premium rates. Standard rates typically price at 0.5 cents per point while premium is much less. Standard awards also have a maximum cap of 250,000 points. The next 3 sections offer some quirks of paying for Hilton Honors stays.

Pay with Points and Money

Hilton allows for the flexibility to pay with a combination of points and cash, where the number of points can be reduced by 1,000 point increments. Usually poor value, since the cost to do so with cash is a hair less than the award cents per point.

Fifth Night Free

For Hilton members that have Silver, Gold, or Diamond status, every award stay with 5 or more consecutive nights will have the fifth night free. The maximum number of nights per stay is 20 nights, so a total of 4 free award nights per stay. Note that pay with points and cash will not trigger this benefit.

No Resort Fees

Award stays don't have resort fees imposed.

Points Pooling

Members can transfer up to 500,000 points to another member and receive up to 2 million points each year. Note that to join a pool, the joining member must have held their account for at least 30 days and at least 1,000 points.

Donating Points

Hilton allows for donation of points through a program called points worthy.

Partner Redemptions

Here are all the additional ways that Hilton points can be redeemed with their partners but

these all represent terrible value.

Amazon: Pay for Amazon purchases for 0.2 cents per point.

Event Vouchers: Buy $50 event vouchers for meetings and events at Hilton for 0.2

cents per point.

Car Rental: Pay with points at Alamo, Enterprise, or National for 0.2 cents per

point.

Lyft: Buy Lyft credit for 0.22 cents per point.

Ticketmaster: Pay Ticketmaster purchases for 0.2 cents per point.

Transfer Partners: Transfer

Hilton points

at a rate of 10,000 Hilton points to 1,000-2,600 airline miles. Most airlines fall under the

1,000 range, meaning 1 airline mile per 10 Hilton points.

Hilton Elite Status

Elite Status Requirements

Hilton now has 4 tiers of elite status after general members.

Here are the requirements to earn each status tier:

Silver: 10 nights, 4 stays or $2,500 USD spend

Gold: 25 nights, 15 stays, or $6,000 USD spend

Diamond: 50 nights, 25 stays, or $11,500 USD spend

Diamond Reserve: 80 nights or 40 stays, and $18,000 USD annual eligible spend

Just like all major hotel groups, elite nights and points are only earned when booking

direct or through portals like Amex FHR and Chase the Edit. It is

my opinion that the easiest way to qualify for Hilton elite status is to hold the applicable credit card.

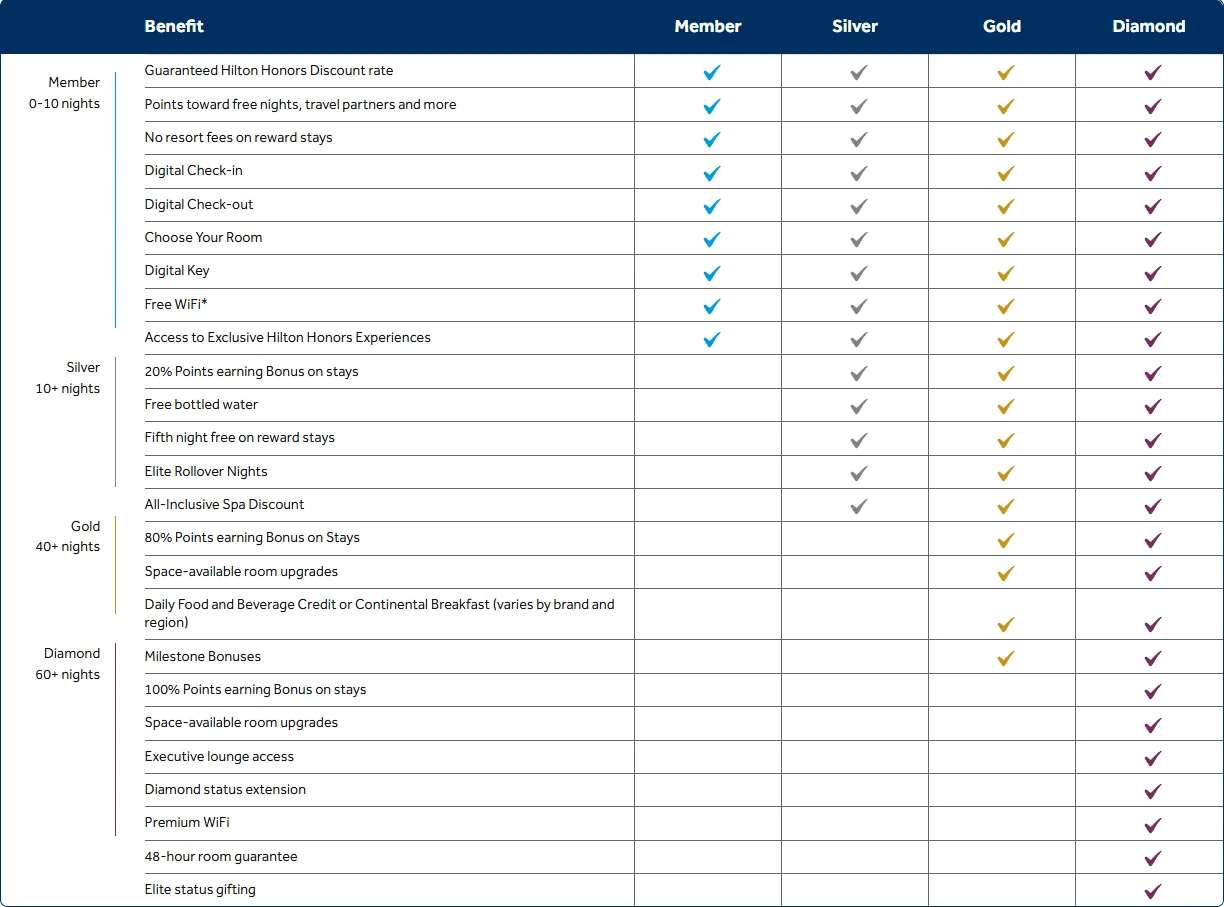

Elite Status Benefits

Gold is the sweet spot to receive the food and beverage credit. The 4 pm guaranteed late check-out

from Diamond Reserve is a great perk, but being locked behind a paywall of $18,000 makes it unappealing

to seek after.

Other benefits I value are as below:

- Fifth night free

- Free Bottled Water (I know it's odd but I hate paying for water and some hotels don't have water fountains.)

- Executive Lounge Access

- Space Available Room Upgrades

- Late Check-Out (subject to availability)

Lifetime Diamond Status

Hilton has one way to earn lifetime status. Lifetime diamond status is earned by being a diamond member for 10 years and either earning 2 million base points or $200,000 in Hilton stays.

Rollover Elite Nights

Any excess elite nights after reaching a certain status threshold will count towards the elite qualification of next year.

Milestone Rewards

After reaching 40 elite nights, earn 10,000 bonus points. For every 10 elite nights after that, earn another 10,000 bonus points. At 60 elite nights specifically, earn 30,000 bonus points instead. At 120 elite nights specifically, earn either 30,000 bonus points or a confirmable upgrade rewards. Honestly, pretty lackluster considering the other hotel program milestone rewards can give guaranteed suite upgrade certificates.

Status Match

Hilton offers status matches from many other programs. The status match comes in the form of a 90 day trial, where staying a certain number of nights can retain that status for the rest of the year. The threshold is 8 nights for Gold and 14 nights for Diamond.

Hilton Honors Credit Cards

Hilton lineup of credit cards is perhaps the most overpowered in the game. The

Aspire card gives so much outsized value

while the Surpass card provides great multipliers for a co-branded card and a worthwhile incentive to spend on

the card.

Hilton Honors

The no annual fee Hilton Honors is a great downgrade option, like every no annual fee co-branded credit card. However, the free card punches above its weight class in several ways. The card comes with automatic Hilton Silver status, which unlocks the Hilton 5th night free on award stays. Also, the card has a chance to earn a Hilton Free Night certificate as an elevated welcome offer a couple times throughout the year. This certificate is applicable to any Hilton Hotels worldwide that have a stand room award night. Since these certificates can be used for SLH hotels, which are usually retailing for $1000+, they are extremely valuable and a great incentive to chase with spend.

Hilton Honors Surpass

Like all Amex cards these days, it comes with credits to offset the annual fee, but the credits for this card are pretty easy to use. The $50 every quarter could be used when purchasing a Hilton gift card online (if it comes back) or at Hilton and restaurants located inside Hilton hotels. The card also comes with Hilton Gold status, the same status the American Express Platinum. Surprising, the card earns 6x (effectively 3%) on groceries, gas, and dining and 3x (effectively 1.5%) everywhere else, making it a decent everyday earner. In addition, the card also incentives spend by granting 1 Hilton Free Night Certificate after $15,000 of spend a year.

Hilton Honors Aspire

The most hyped up (and for good reason) of all credit cards, THE Hilton Aspire. The already comes with decently easy to use coupons that give $600 in value, more than the annual fee. The card grants Hilton's top tier status, Diamond status. This makes Hilton status the easiest to achieve. The card also grants a free night certificate each year. This card is the king of all cards!

Hilton Honors Business

The card once again comes with $60 a quarter at Hilton. The card also gives Hilton Gold status, like the Hilton Surpass. The card's main draw is the 5x (effectively 2.5%) multiplier on everything. However, there is a cap of $100,000 a year and no free night certificate as a spend incentive. Unfortunately, the direction that Hilton took is quite puzzling. The existence of a cap will drive away high business spenders and for the average Joe, the lack of a spend incentive may cause them to look else where (like welcome offers) to concentrate their spend on.