Table of Contents

Ultimate Guide to Marriott Hotels

For those that travel less than 5 times a year, Marriott is a fantastic program. For casual travelers, Marriott offers unique perks that do not require sinking much time or money into the program. I am here to walk you through how to get the most out of the Marriott Bonvoy program!

Top 5 Takeaways

- Largest Footprint: Marriott has the most hotels in the world. Destinations worldwide with hotels would often have at least 1 Marriott property.

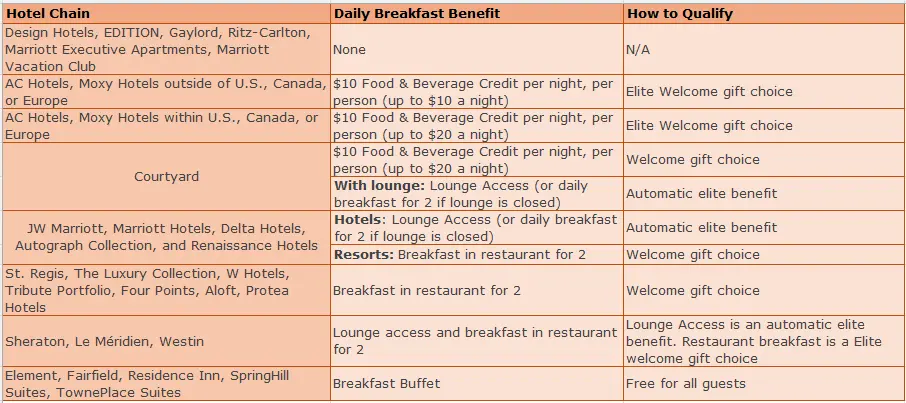

- Elite Food Benefit: Elite status "food" benefit comes with Marriott Bonvoy Platinum status or higher. However, there are exclusions, notably the Ritz Carlton, Edition, and vacation club brands.

- 5th Night Free: The 5th night is free on all award bookings.

- Airline Benefits: Marriott Titanium status will grant Aeroplan 25k and United Silver status.

- Credit Card EQN: Earn elite qualifying nights (EQN) from maximum of 1 personal and 1 business card.

Earning Marriott Bonvoy Points

Marriott Stays

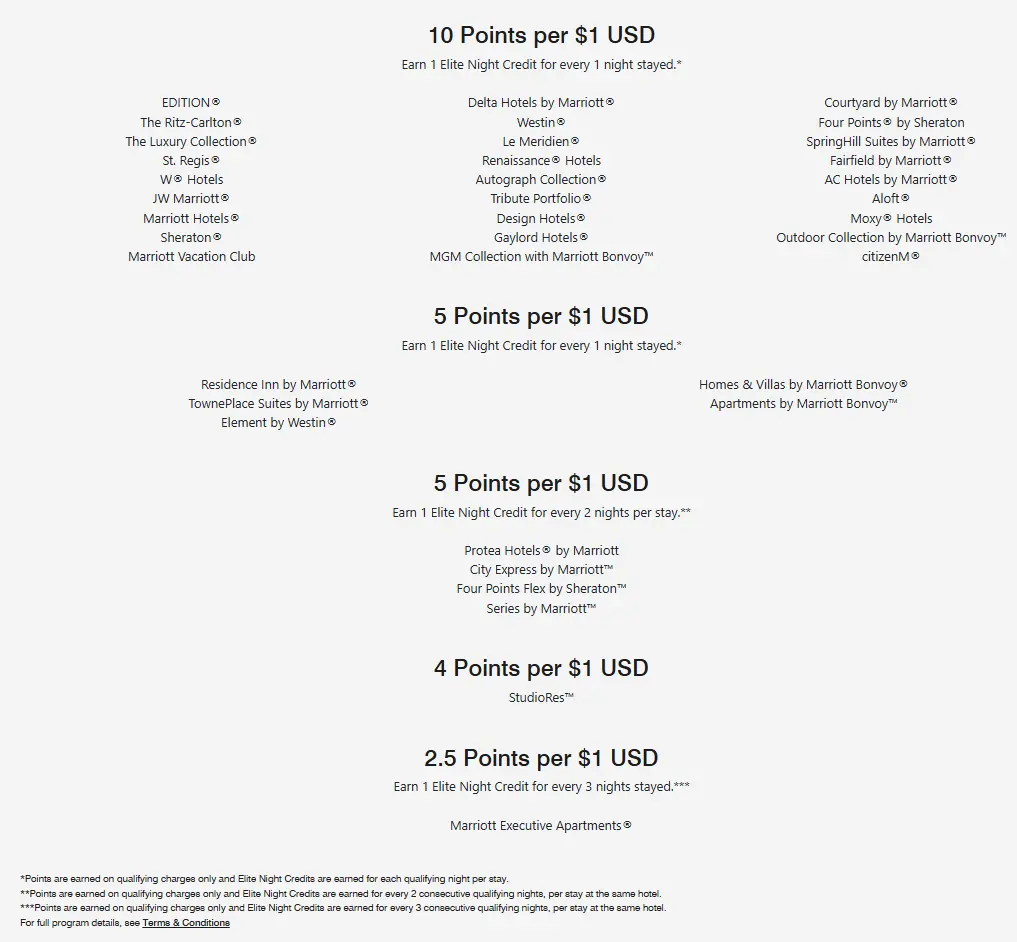

The Marriott points earning rate is based on the amount of money spent. Most brands earn 10

point per dollar spent. Brand exclusions include Residence Inn, TownePlace Suites, Element,

Homes & Villas, Sonder, Protea Hotels, City Express, Four Points Flex by Sheraton which earn 5 points

per dollar. StudioRes brand earns 4 points per dollar while Marriott Executive Apartments earn 2.5 points

per dollar. Each level of elite status earns a bonus percentage on points earned.

General Member: 10% bonus or 10 points per dollar (most brands)

Silver: 10% bonus or 11 points per dollar (most brands)

Gold: 25% bonus or 12.5 points per dollar (most brands)

Platinum: 50% bonus or 15 points per dollar (most brands)

Titanium & Ambassador : 75% bonus or 17.5 points per dollar (most brands)

Please do note that like most other hotel programs, booking through third party like Expedia

or travel portals

don't earn points. There are also frequent lucrative promotions, like ones that triple the amount base

points earned.

Buying Points

Marriott points are usually sold for 1.25 cents per point. However, points are frequently on sale for 0.89 cents per point, which I would consider the floor for these points.

Meetings and Events

Earn 2 point per dollar when hosting a meeting or event at a Marriott hotel, up to 105,000 points each year for Titanium and Ambassador Elite members and 60,000 points each year for everyone else. Swap Marriott points for up to 20,000 airline miles instead. Earn 1 Elite Night Credit for every 20 room nights you book, up to 20 Elite Night Credits per event.

Dining Portal

Much like other programs, a credit card can be linked to their dining program to earn Marriott Bonvoy points on partnered restaurants. Note that linking a credit card to one dining program will usually unlink it from others. Earn 6 points per dollar for elite members and 4 points per dollar for every one else. As Marriott points are not worth that much, I would advise against this.

Transfer Partners

All of the below transfer partners represent a poor value at the ratio they are transfer. At

the transfer ratio listed below, I would highly discourage transferring.

Everyday Partners

Redeeming Marriott Bonvoy Points

Marriott Stays

Marriott has a secret award chart, but the ranges are so large that it is pretty much dynamic. Keep in mind that if resort fees are applicable, then the resort fees will be tacked on to the award cost. The next 2 sections offer some quirks of paying for IHG stays.

Pay with Points and Money

Marriott allows for the flexibility to pay with a combination of points and cash. Usually poor value, since the cost to do so with cash is a hair less than the award cents per point.

Fifth Night Free

For Marriott members that have Silver, Gold, or Diamond status, every award stay with 5 or more consecutive nights will have the fifth night free. The maximum number of nights per stay is 20 nights, so a total of 4 free award nights per stay. Note that pay with points and cash will not trigger this benefit.

Points Pooling

Members can transfer up to 100,000 points to another member and receive up to 500,000 points each year. Transfers are in 1,000 point increments and only 2 transfers per calendar month and 6 transfers per calendar year.

Marriott Moments

Members can redeem points either for a fixed cost or for an auction at Marriott Moments. Given how popular Marriott is, finding good prices for the auctions are really hard.

Donating Points

Marriott allows for donation of points by calling the hotel.

Partner Redemptions

Here are all the additional ways that Marriott points can be redeemed with their partners but

these all represent terrible value, although transferring to MGM might not be the worst deal.

Marriott Elite Status

Elite Status Requirements

Marriott now has 4 tiers of elite status after general members. Each night stayed, whether it's a cash, award, or credit

card elite nights, will count toward the elite night threshold.

Here are the requirements to earn each status tier each year:

Just like all major hotel groups, elite nights and points are only earned when booking direct or through portals like Amex FHR and Chase the Edit. It is my opinion that the easiest way to qualify for Marriott elite status is to hold the applicable credit card.

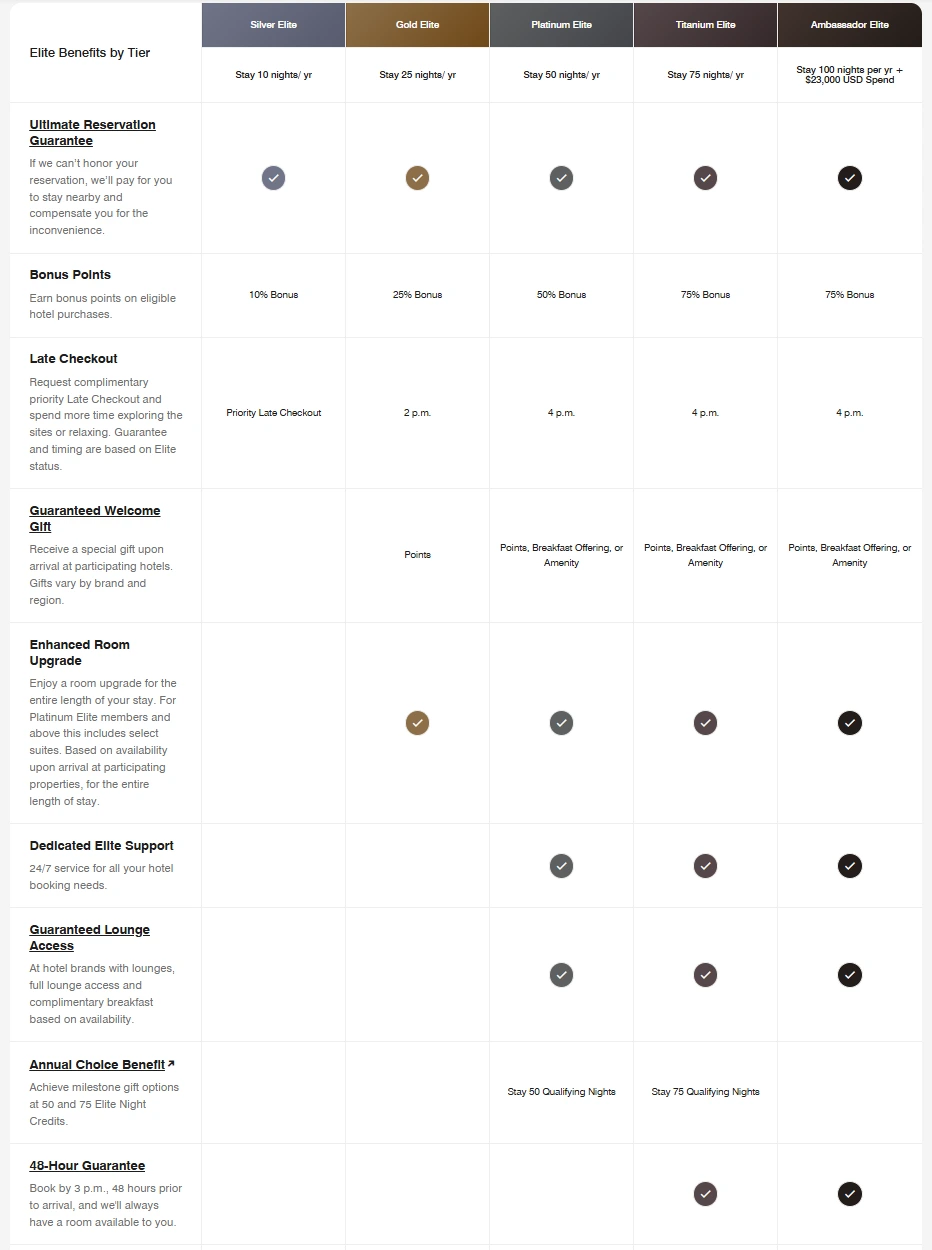

Elite Status Benefits

Platinum is the sweet spot to receiving "breakfast benefits" and lounge access. More on that in a later section.

4 pm late checkout is nice but not being guaranteed means it will not be offered most often than not.

Other benefits I value are as below:

- Free breakfast (when offered)

- Executive Lounge Access

- Ultimate Reservation Guarantee

- United Silver and Aeroplan 25k Status (Titanium and Ambassador only)

- Space Available Room Upgrades

- Late Check-Out (subject to availability)

Lifetime Status

Marriott has the ability to earn lifetime

status, up to platinum status. THe following are the thresholds to reach each lifetime status:

Silver: 250 lifetime elite nights and 5 years of silver status or higher

Gold: 400 lifetime elite nights and 7 years of gold status or highers

Platinum: 600 lifetime elite nights and 10 years of platinum status or higher

Breakfast Benefit

Unfortunately, Marriott does not provide free breakfast at every location and various policies on breakfast differ between brands. The various credits or complimentary breakfast you can expect to receive are displayed in the table above.

Choice Benefits

There are 2 times where you can choose an extra reward each year, at 50 elite nights and at 75 elite nights.

Note that lifetime platinum status won't earn elite nights automatically, thus will have to earn 50 elite nights otherwise

to obtain the choice benefits.

50 Night Choices

- 5 Nightly upgrade awards that are each able to be used on an entire stay, only confirmed 5 days before the stay. For the St. Regis, Ritz Carlton, and the EDITION, the upgrades are confirmed 3 days before the stay. Each upgrade award can only be used for 1 night and can only be cleared 5 days before the stay.

- 5 elite night credits to add towards the next status level

- Gift Silver elite status

- $100 charity donation

- $1000 off a Marriott bed

- 50 Night Choices (gift gold elite status instead of silver elite status)

- 1 free night award up to 40,000 Marriott points

Elite Benefit Guarantees

Marriott does a great job outlining a policy that can be clearly pointed to when hotels don't honor elite perks. You are entitled to

receive compensation. Compensation is allowed for not

honoring the following elite benefits:

- Ultimate Reservation Guarantee (all elites): Unable to honor reservations

- Guaranteed Welcome Gift (platinum elite and up): Unable to honor breakfast, gift, or points

- Guaranteed Room Type (platinum elite and up): Unable to honor room type reservations. Not available at certain brands

- Guaranteed Lounge Access (platinum elite and up): Unable to provide lounge access

- 48-Hour Guaranteed Availability (titanium elite and up): Unable to provide a room within 48 hours.

Credit Card Elite Night Credit

In addition to Marriott credit cards automatically achieving status, they also come with elite nights awarded each year to help climb higher than the status provided. Most credit cards give 15 elite night credits, with the exception of the Amex Bonvoy Brilliant card, which comes in at 25 elite night credits. Keep in mind that these credits are not free nights to stay at a Marriott hotel, but only are there for elite status recognition. Unfortunately, only 1 personal card and 1 business Marriott card can contribute to elite night credits each year. This means that having multiple personal Marriott cards will only contribute 15 elite night credits, unless you have the Amex Bonvoy Brilliant, which contributes 25. Likewise for the business Marriott cards. The strategy here is to hold both the Amex Bonvoy Brilliant and the Marriott business cards to achieve 40 elite nights.

Status Match

Marriott only offers status matches through call. A lot of hassle for otherwise mediocre status benefits.

Marriott Bonvoy Credit Cards

They are amongst the most expensive yet most hated cards in the game. Some of the perks are really strong,

yet others are incredibly weak. I am here to go over some of the cards. The brand had a history of

a huge merger with Starwood hotels, leading to co-branded cards with 2 different banks. Marriott

was originally with Chase, while the Starwood brand was with Amex. In today's landscape, Chase typically

holds the lower annual feel cards while Amex holds the higher annual fee ones.

Chase Marriott Bonvoy Bold

The no annual fee Marriott Bonvoy is a great downgrade option, like every no annual fee co-branded credit card. However, the free card punches above its weight class in several ways. The card comes with automatic Marriott Silver status, although not much, is still something. You also get a pay yourself back feature for direct airline and Marriott bookings, only on this card. This lets you cash out 12,500 Marriott points for $100 statement credit, up to $750 per year, at a rate of 0.8 cents per point. This means redemptions under than 0.8 cents per point would be better off redeemed for statement credit and paid with cash.

Chase Marriott Bonvoy Boundless

The Marriott Bonvoy Boundless card is good for 2 purpose after the welcome offer, the 35k free night certificate and the Marriott silver status. Pegging each point at 0.8 cents per point, I would say that the free night certificates should at least be worth $280 if redeemed correctly. That exceeds the annual fee, which means that this card is a keeper card. The free night certificates can be topped off with a maximum of 15,000 additional Marriott points, so up to 50,000 point certificate. Note that in 2026, this card also comes with $100 in a airline statement credits, making this a greater card to keep.

Chase Marriott Bountiful and Amex Marriott Bonvoy Bevy

This is by far the worst cards in their lineup. For an annual fee of $250, both cards offer Marriott gold status and no free night certificate without spend. They have the highest Marriott multipliers but they are not competitive with other credit cards at all. If you want Marriott Gold status, apply for the Amex Marriott Business card instead.

Amex Bonvoy Brilliant

This is the highest annual fee Marriott card and it definitely packs a punch. The card offers 3 big incentives, Marriott platinum status (what I consider to be the sweet spot), 25 elite night credits to help you reach Titanium or Ambassador status faster, and a 85,000 point free night certificate. The platinum status unlocks complimentary suite upgrades and breakfast benefits. The 85,000 point free night certificate is worth $680, with each point worth 0.8 cents per point. Once again, the free night certificates can be topped off with a maximum of 15,000 additional Marriott points, so up to 100,000 point certificate. The card comes with monthly dining credits to further offset the annual fee. For Marriott loyalist, this card is definitely worth the annual fee.

Marriott Bonvoy Business

This card is pretty much a mirror copy of the Chase Bonvoy Boundless card. The only difference is the annual fee being $30 higher, business room rate discount, categories for bonus spend, and that the elite night credits stack with personal cards. Holding this card and the Amex Bonvoy Brilliant card will automatically propel you to 40 elite night credits each year.

Amex Marriott Bonvoy and Chase Ritz Carlton

There are 2 Marriott cards that were discontinued during the merger, yet can still be product changed into. The Amex Marriott Bonvoy is very similar to the Chase Marriott Boundless card in that it is under $100 annual fee and provides a 35,000 Marriott point free night certificate. It is a good option for downgrading the Marriott Brilliant or Bevy cards. The Ritz Carlton card is the card everyone talks about, primarily due to its overpowered priority pass. The card allows for unlimited authorized users with $0 annual fee and priority pass for each authorized user. Each of those priority pass holders gets access to the Chase Sapphire lounges the same way a Chase Sapphire Reserve card holder would. This card's priority pass also gets the same travel and purchase protections as the Chase Sapphire Reserve card. This makes this card very similar to the travel benefits obtained on the Chase Sapphire Reserve for a much lower annual fee.